Letter of credit (LC) is a safe and secure way to make payments in import export business. In this, the bank (of importer) guarantees that the seller will receive payments for his goods and products. In letter of credit (LC) both importer’s and exporter’s participating banks are involved in payment transactions. It is the most secure way to make payments in international trade.

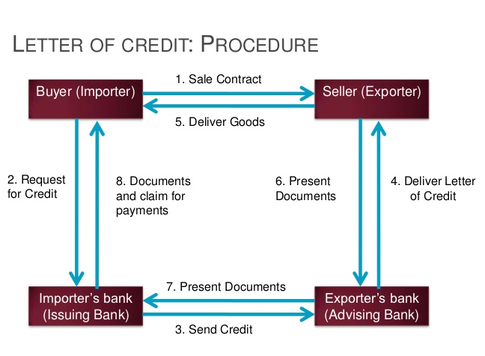

In this process, the buyer (importer) contacts the seller (exporter) for his goods and sets the deal with the seller. After that, importer asks for the letter of credit method of payments, if both buyer and seller agree on letter of credit payments transaction.

In this process, the buyer (importer) contacts the seller (exporter) for his goods and sets the deal with the seller. After that, importer asks for the letter of credit method of payments, if both buyer and seller agree on letter of credit payments transaction.

When both buyer and seller agree on LC then buyer requests his bank to issue the letter of credit (LC). Importer bank sends credit to seller bank and bank delivers letter of credit to seller. When seller receives the letter of credit, seller sends his goods to buyer through Carrier Company. When the goods or products reach the buyer’s destination, the buyer presents the documents which are sent by seller through banks. Buyer bank gives documents to buyer and claims for payments of goods or products.